Build-to-Rent in Spain: Key lessons from Madrid’s growing rental market

Build-to-Rent in Spain: Key lessons from Madrid’s growing rental market

Introduction

Urbanisation continues to redefine the shape of our cities and the way we live. While much attention has been paid to rapid growth in Asia and Africa, Europe is undergoing its own transformation, with Spain arguably at the forefront. By 2050, nearly 70% of the global population is expected to live in urban areas, and the pressure this places on housing markets is already being felt.

Spain presents a particularly striking case. Following the 2008 financial crisis, the country shifted from an oversupplied residential market to one marked by significant shortfalls. Today, this imbalance, exacerbated by economic shifts and evolving lifestyles, is creating both urgency and opportunity for innovation in housing delivery.

Demographic trends are playing a central role in this change. In 2023, the median age for first-time home ownership in Spain was 41. In addition, a growing number of students accessing higher education and increasing workforce mobility are driving demand for rental accommodation that is flexible, high-quality, and professionally managed. The global rise in Build-to-Rent (BtR) and Co-living models reflects this evolution - part of a broader shift away from traditional ownership and towards more service-oriented residential experiences.

In Spain, BtR has gained traction in recent years, particularly since 2019. However, rising development costs, inflationary pressures, and multiple layers of policy complexity have slowed delivery. With nearly half of institutional, metropolitan BtR stock concentrated in the Madrid metro area, the capital offers a compelling lens through which to examine the opportunities and challenges that lie ahead.

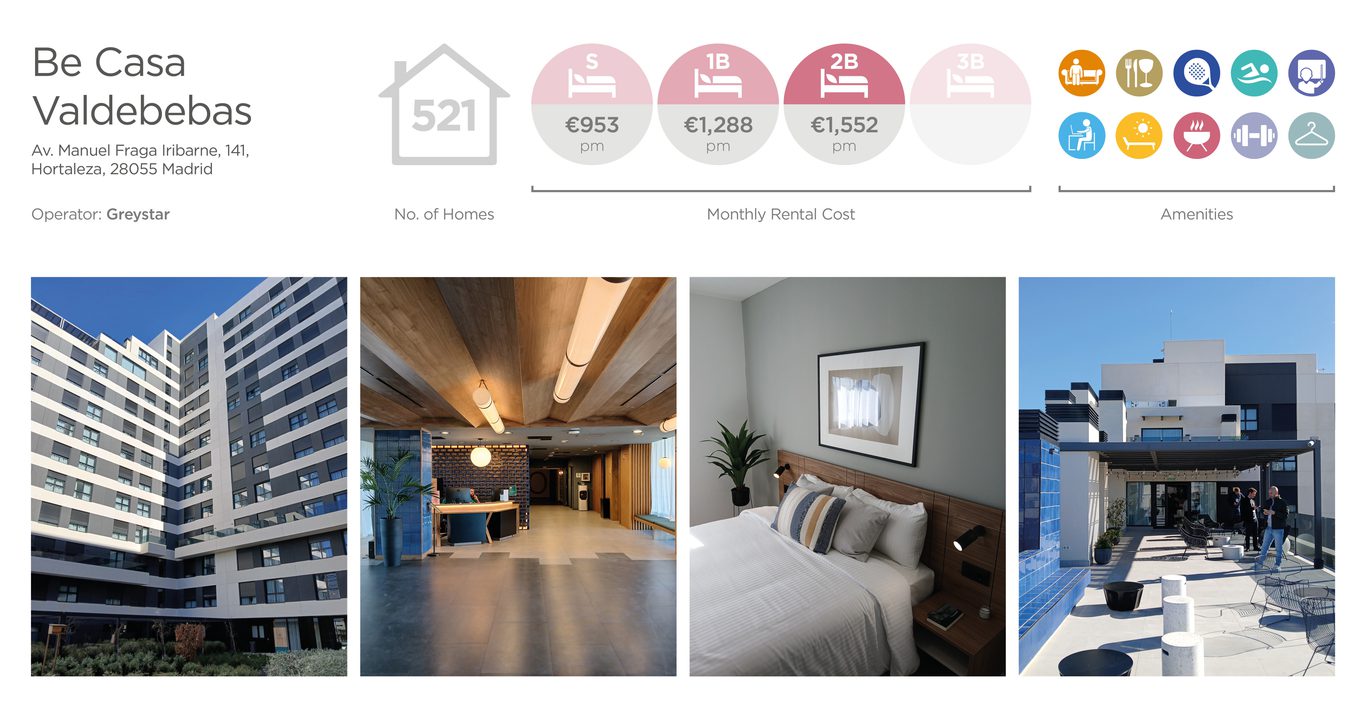

Be Casa Valdebebas: A scale-driven flex rental model with hospitality-inspired design and an emphasis on service-led living.

This insight paper by Group Board Director Michael Swiszczowski explores the drivers shaping Madrid’s emerging BtR sector, from demographic pressures and regulatory reform to design responses and operational innovation. In doing so, it highlights how Spain’s rental housing market is being redefined, not only by demand, but by the creative solutions now being adopted to meet it.

This paper is intended for potential investors—both international and domestic—who are exploring opportunities in Spain’s evolving Build-to-Rent (BtR) market. With strong underlying demand, shifting housing preferences, and growing institutional interest, Spain presents a compelling case for strategic investment. However, navigating this emerging sector requires a clear understanding of the regulatory environment, planning challenges, and market dynamics. By offering insight into the demographic drivers, legal frameworks, and design-led solutions shaping the future of rental housing, this paper aims to equip investors with the knowledge needed to make informed, future-ready decisions in a rapidly transforming landscape.

Be Casa Essential Barajas: A clean, modular BtR development with bold interiors and curated amenities for flexible city living.

Introduction

Urbanisation continues to redefine the shape of our cities and the way we live. While much attention has been paid to rapid growth in Asia and Africa, Europe is undergoing its own transformation, with Spain arguably at the forefront. By 2050, nearly 70% of the global population is expected to live in urban areas, and the pressure this places on housing markets is already being felt.

Spain presents a particularly striking case. Following the 2008 financial crisis, the country shifted from an oversupplied residential market to one marked by significant shortfalls. Today, this imbalance, exacerbated by economic shifts and evolving lifestyles, is creating both urgency and opportunity for innovation in housing delivery.

Demographic trends are playing a central role in this change. In 2023, the median age for first-time home ownership in Spain was 41. In addition, a growing number of students accessing higher education and increasing workforce mobility are driving demand for rental accommodation that is flexible, high-quality, and professionally managed. The global rise in Build-to-Rent (BtR) and Co-living models reflects this evolution - part of a broader shift away from traditional ownership and towards more service-oriented residential experiences.

In Spain, BtR has gained traction in recent years, particularly since 2019. However, rising development costs, inflationary pressures, and multiple layers of policy complexity have slowed delivery. With nearly half of institutional, metropolitan BtR stock concentrated in the Madrid metro area, the capital offers a compelling lens through which to examine the opportunities and challenges that lie ahead.

This insight paper explores the drivers shaping Madrid’s emerging BtR sector, from demographic pressures and regulatory reform to design responses and operational innovation. In doing so, it highlights how Spain’s rental housing market is being redefined, not only by demand, but by the creative solutions now being adopted to meet it.

Evolving Lifestyles, Shifting Needs: Housing Demand in Modern Spain

Spain’s housing market is being reshaped by a powerful combination of demographic, social, and economic forces. As the number of households continues to grow, supply has failed to keep pace, particularly in urban centres. This mismatch is driving up prices and creating affordability challenges across both rental and sales markets.

While Spain’s GDP per capita has shown steady growth, this increase has been largely nominal. Wages have not risen at the same rate as housing costs, pushing the average rent-to-income ratio to around 38% - noticeably above the widely adopted 33% affordability threshold. In high-demand areas like Ibiza, these pressures are even more acute, with local populations increasingly priced out of the communities they call home.

Madrid has seen some relief through suburban expansion and enhanced transport links, but a nationwide shortfall of over 2 million affordable homes remains. This supply gap has catalysed the emergence of alternative housing models that challenge traditional typologies. Co-living, corporate living, and flex living are three key approaches gaining ground, each responding to a distinct set of resident needs.

· Co-living offers compact, service-driven living spaces - popular with students and young professionals who prioritise flexibility and community.

· Flex living caters to a mobile demographic – young professionals, digital nomads and entrepreneurs - seeking convenience and more experiential living.

· Corporate living targets business corporates, entrepreneurs and wealthier individuals, providing premium services in desirable locations.

Though still modest in volume, these formats are scaling quickly. The number of operational flex and co-living units is expected to more than double between 2024 and 2027—from 11,885 to over 26,700. What’s emerging is a more diverse and adaptable housing landscape, one that reflects how people’s lifestyles, work habits, and expectations of ‘home’ are changing.

Navigating Uncertainty: Legal Reform and Market Adaptation

As Spain’s housing needs evolve, so too does its regulatory landscape. Yet rather than providing clarity, recent legal reforms have introduced additional layers of complexity for developers and investors alike. For institutional rental models such as Build-to-Rent (BtR) and flex living, navigating this shifting terrain is becoming a strategic necessity.

The 2019 reform of the Urban Lease Law marked a significant shift. It introduced tighter rent controls and enhanced tenant protections, moves that, while socially motivated, reduced the financial predictability that institutional investors typically rely on. More recently, the 2023 State Housing Law has enabled regional governments to impose rent caps in designated “stressed” market zones, with Catalonia leading the way. Other regions are expected to follow.

In parallel, rising incidents of squatting, enabled by legal loopholes that can delay evictions by over a year, have raised risk profiles across the sector. Some proposals now under discussion, such as steep property taxes for non-EU investors, adds to the growing cautionary sentiment.

Against this backdrop, developers are seeking creative workarounds. Flex living, for example, operates under short-term leases (under one year), which are not classified as residential under Spanish law. This allows for development on tertiary or industrial land, typically less expensive and more lightly regulated. In contrast, traditional BtR remains subject to residential zoning and lease restrictions, narrowing its financial margins and increasing exposure to legislative shifts.

As José from DLA Piper observes, Spain’s legal trajectory echoes trends seen in the UK, but filtered through a uniquely local lens. His advice to market entrants is clear:

· Proceed with caution in Catalonia, where rent controls and the legal landscape are most stringent.

· Explore flex models strategically, but ensure thorough due diligence on zoning, land classification, and municipal regulations.

The message is simple: innovation must go hand-in-hand with legal agility. Successful schemes will be those that balance ambition with a deep understanding of the evolving legal context.

Unlocking Opportunity: Land Constraints and Planning Realities

Land is the foundation of any development strategy and in Madrid, it’s becoming increasingly clear that location is only part of the equation. While the region boasts robust infrastructure and strong transport links, the availability of land that is both zoned and ready for residential development remains a critical bottleneck.

Much of Madrid’s current urban development framework was conceived before the 2008 financial crisis, under planning regulations that no longer reflect today’s market realities. Rezoning these areas is a complex, multi-tiered process involving municipal, regional, and national authorities. As a result, even strategically located land parcels can remain tied up in red tape, delaying delivery and adding cost.

For developers and investors, this calls for a strategic rethink. Inflexible zoning and outdated masterplans are not merely bureaucratic hurdles, they are structural constraints that limit the potential of the BtR sector. In this context, some forward-thinking operators are exploring alternative land classifications, such as tertiary or industrial zones, particularly for flexible living models. These sites often carry lower land costs and are subject to less stringent housing regulations, offering a way to unlock value whilst navigating traditional barriers.

However, this approach is not without risk. Zoning laws vary by municipality, and what works in one district may not be feasible in another. Success, therefore, depends on local knowledge, proactive engagement with planning authorities, and a willingness to innovate, both in design and delivery strategy.

Conclusion

Spain’s urban housing market stands at a pivotal moment, shaped as much by constraint as by opportunity. As affordability challenges mount and demographic profiles evolve, the traditional homeownership model is being redefined. In its place, more flexible, service-led models are emerging. Build-to-Rent, Co-living and Flex living are no longer fringe alternatives; they are timely responses to the realities of modern urban life.

Delivering these models at scale, however, will require more than just market demand. It calls for regulatory reform, planning flexibility, design excellence, and sustained investor confidence. Architecture and interior design will play a central role in translating new living models into environments that feel residential, functional, and human. Good design can bridge the gap between density and liveability, creating homes that support wellbeing, sustainability, and contemporary patterns of living, working and social connection.

Madrid exemplifies the complexities, and the potential, of this shift. Its rental market is becoming a testbed for new typologies, design strategies, and policy innovations. Navigating Spain’s layered legal frameworks, zoning constraints, and shifting societal priorities will be key to unlocking long-term success.

With proactive collaboration between the public and private sectors, and a willingness to rethink outdated norms, Spain has the opportunity to deliver a more adaptable, inclusive, and resilient housing future, one that reflects not only how people live today, but how they will want to live tomorrow.

Captions:

Node Madrid Carabanchel A bold, high-density flex-living concept combining layered amenities with adaptable unit design.

Casa Dumont, Getafe Thoughtfully designed suburban BtR community with generous balconies, shared green space, and natural light.

Nera Living Atocha Urban living redefined—elegant interiors, sculpted amenity zones, and a seamless connection to city life.

Be Casa Essential Barajas A clean, modular BtR development with bold interiors and curated amenities for flexible city living.

STAY by Kronos Torrejón Contemporary suburban living designed around families, terraces, and vibrant shared social spaces.

Be Casa Valdebebas A scale-driven flex rental model with hospitality-inspired design and an emphasis on service-led living.

Node Madrid Carabanchel: A bold, high-density flex-living concept combining layered amenities with adaptable unit design.

Navigating Uncertainty: Legal reform and market adaptation

As Spain’s housing needs evolve, so too does its regulatory landscape. Yet rather than providing clarity, recent legal reforms have introduced additional layers of complexity for developers and investors alike. For institutional rental models such as Build-to-Rent (BtR) and flex living, navigating this shifting terrain is becoming a strategic necessity.

The 2019 reform of the Urban Lease Law marked a significant shift. It introduced tighter rent controls and enhanced tenant protections, moves that, while socially motivated, reduced the financial predictability that institutional investors typically rely on. More recently, the 2023 State Housing Law has enabled regional governments to impose rent caps in designated “stressed” market zones, with Catalonia leading the way. Other regions are expected to follow.

In parallel, rising incidents of squatting, enabled by legal loopholes that can delay evictions by over a year, have raised risk profiles across the sector. Some proposals now under discussion, such as steep property taxes for non-EU investors, adds to the growing cautionary sentiment.

Against this backdrop, developers are seeking creative workarounds. Flex living, for example, operates under short-term leases (under one year), which are not classified as residential under Spanish law. This allows for development on tertiary or industrial land, typically less expensive and more lightly regulated. In contrast, traditional BtR remains subject to residential zoning and lease restrictions, narrowing its financial margins and increasing exposure to legislative shifts.

As José from DLA Piper observes, Spain’s legal trajectory echoes trends seen in the UK, but filtered through a uniquely local lens. His advice to market entrants is clear:

· Proceed with caution in Catalonia, where rent controls and the legal landscape are most stringent.

· Explore flex models strategically, but ensure thorough due diligence on zoning, land classification, and municipal regulations.

The message is simple: innovation must go hand-in-hand with legal agility. Successful schemes will be those that balance ambition with a deep understanding of the evolving legal context.

Casa Dumont, Getafe: Thoughtfully designed suburban BtR community with generous balconies, shared green space, and natural light.

Unlocking Opportunity: Land constraints and planning realities

Land is the foundation of any development strategy and in Madrid, it’s becoming increasingly clear that location is only part of the equation. While the region boasts robust infrastructure and strong transport links, the availability of land that is both zoned and ready for residential development remains a critical bottleneck.

Much of Madrid’s current urban development framework was conceived before the 2008 financial crisis, under planning regulations that no longer reflect today’s market realities. Rezoning these areas is a complex, multi-tiered process involving municipal, regional, and national authorities. As a result, even strategically located land parcels can remain tied up in red tape, delaying delivery and adding cost.

For developers and investors, this calls for a strategic rethink. Inflexible zoning and outdated masterplans are not merely bureaucratic hurdles, they are structural constraints that limit the potential of the BtR sector. In this context, some forward-thinking operators are exploring alternative land classifications, such as tertiary or industrial zones, particularly for flexible living models. These sites often carry lower land costs and are subject to less stringent housing regulations, offering a way to unlock value whilst navigating traditional barriers.

However, this approach is not without risk. Zoning laws vary by municipality, and what works in one district may not be feasible in another. Success, therefore, depends on local knowledge, proactive engagement with planning authorities, and a willingness to innovate, both in design and delivery strategy.

Nera Living Atocha: Urban living redefined—elegant interiors, sculpted amenity zones, and a seamless connection to city life.

Conclusion

Spain’s urban housing market stands at a pivotal moment, shaped as much by constraint as by opportunity. As affordability challenges mount and demographic profiles evolve, the traditional homeownership model is being redefined. In its place, more flexible, service-led models are emerging. Build-to-Rent, Co-living and Flex living are no longer fringe alternatives; they are timely responses to the realities of modern urban life.

Delivering these models at scale, however, will require more than just market demand. It calls for regulatory reform, planning flexibility, design excellence, and sustained investor confidence. Architecture and interior design will play a central role in translating new living models into environments that feel residential, functional, and human. Good design can bridge the gap between density and liveability, creating homes that support wellbeing, sustainability, and contemporary patterns of living, working and social connection.

Madrid exemplifies the complexities, and the potential, of this shift. Its rental market is becoming a testbed for new typologies, design strategies, and policy innovations. Navigating Spain’s layered legal frameworks, zoning constraints, and shifting societal priorities will be key to unlocking long-term success.

With proactive collaboration between the public and private sectors, and a willingness to rethink outdated norms, Spain has the opportunity to deliver a more adaptable, inclusive, and resilient housing future, one that reflects not only how people live today, but how they will want to live tomorrow