The Future of Housing Association Development

Affordable housing is increasingly out of reach for many.

The English Housing Survey 2015-16, released in July 2017 by the Department for Communities and Local Government, is a clear reflection of our national housing crisis:

- Private renters are spending more than a third of their income on rent – a proportion which rises to 45% in London.

- The average age of first-time buyers is 32 – one in five was aged between 35 and 44.

- The mean deposit for all recent first-time buyers was £48,831. In London it was £94,088.

- Two thirds of first-time buyers were in the two highest quintile income bands.

- Almost 30% had help from friends and family with their deposit, up from 22% in 1995-96.

The survey highlights that affordable housing is increasingly out of reach for many.

In February, the housing white paper, “Fixing Our Broken Market”, marked a striking change in housing policy, conceding that private housebuilding for sale could not deliver enough homes to meet demand, nor improve affordability. It suggested a more positive view of Housing Associations within the government.

In this insight paper, Chapman Taylor’s Alison Haigh looks at how Housing Associations (HAs) are adapting to this new environment.

So what does the future hold for Housing Association Development?

De-Regulation

In October 2015, the Office for National Statistics (ONS) announced that HAs would be reclassified as public bodies. This saw the removal of the consents regime for the disposal of stock. Previously, HAs were required to obtain consent from the regulator in relation to any disposals of social housing. With effect from 6th April 2017, the Housing and Planning Act removed the consents regime, which often hampered HAs’ efforts to make the most effective use of their assets, in its entirety.

Funding

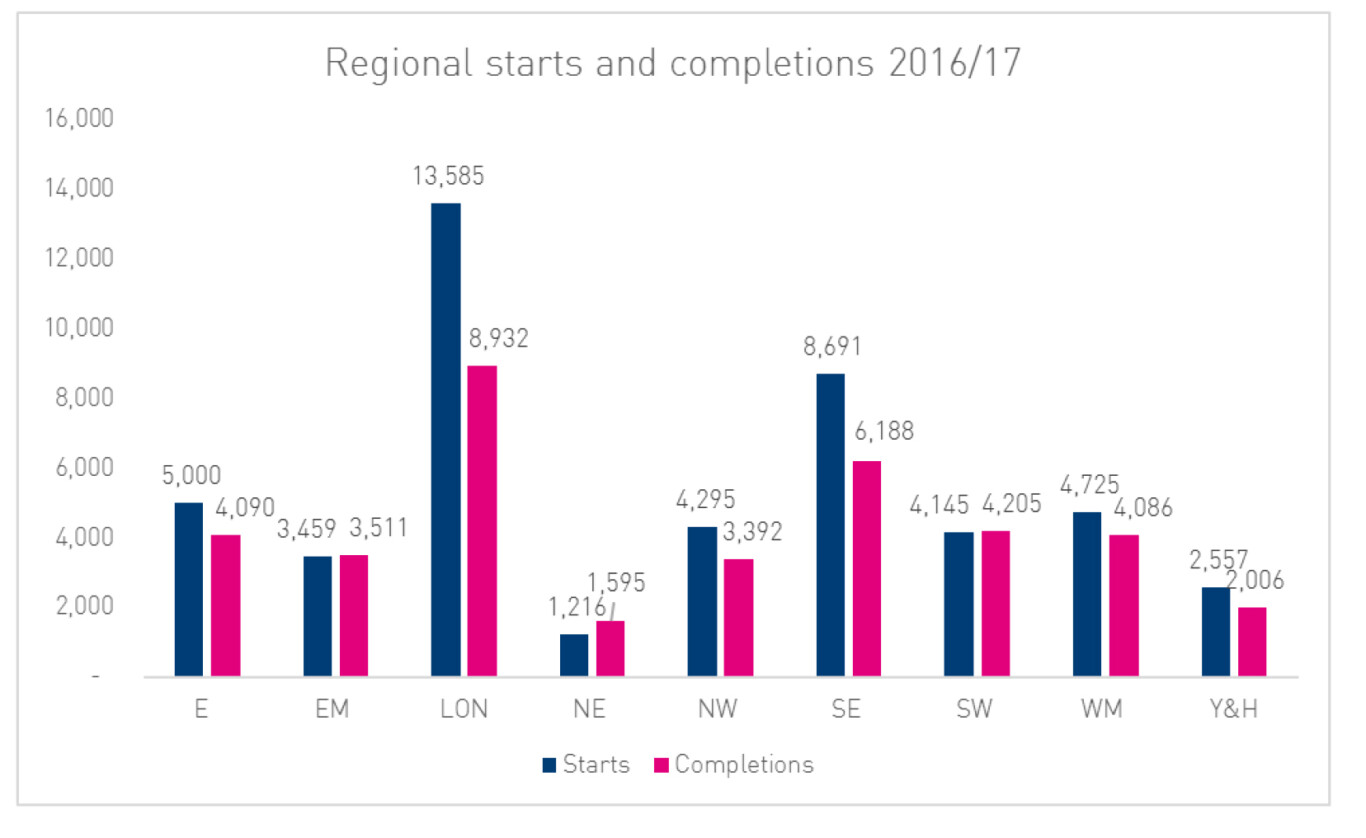

According to the National Housing Federation survey of developing providers, HAs started building nearly 48,000 homes last year, an increase of 13% on 2015.

This increase was partly driven by the additional funding announced in the Autumn Statement, providing a strong boost to HAs’ confidence in development. But a significant proportion of homes started were delivered outside the Affordable Homes Programme. Half (23,972) of the homes were started without any government investment, an increase from 48% the year before.

There are large regional variations. In London, 62% of homes started did not use grant funding – the equivalent figure for the North West was only 28%. This is likely to be due to the higher profits which can be generated through the London sales market to fund development.

Affordable delivery and grant funding peaked in 2008-09 during the global financial crisis. Continuing to deliver affordable homes with less grant funding has required cross-subsidy from profit-making developments. It has had an impact on the tenure of affordable homes being delivered, with affordable rent (set at up to 80% of the market rent) displacing much of what was social rent (typically about 50% of market rent).

Following a sustained period of reduced government funding, last year saw some relief in the form of the £7bn affordable homes fund. In addition, the Mayor of London, Sadiq Khan, set out new planning rules to speed up the building of more affordable housing, alongside plans for how a record-breaking investment of £3.15bn will support 90,000 new affordable homes in the capital.

Finance

Last year Savills’ report, “Releasing untapped potential for more housing”, estimated that HAs have the financial capacity to more than double their output by 2029 through £7.4bn in additional asset-backed borrowing, achieved via a combination of additional borrowing and improved management and maintenance efficiency.

HAs will continue to look at different ways to use their assets to build more urgently- needed homes. Many traditional lenders have a historic position of only accepting around 10–20% of the total security on shared-ownership properties, but this stance has recently changed. Following an £85m long-term financing deal with M&G Investments, One Housing will be building 1,450 homes. This deal is innovative for the housing sector because a high proportion of the collateral comprised shared-ownership properties.

Now that the precedent has been set, this is a deal that other HAs could easily replicate with any number of investors.

HAs started building nearly 48,000 homes last year, an increase of 13% on 2015.

Market Homes

Of the homes started last year, 20% (9,649) were for market rent or sale, the profits made from these homes being reinvested back into new delivery.

Developing housing in the open market has an increasing part to play in supporting the sector’s core charitable objectives. A growing number of associations plan to deliver market rent. The sector already has a wealth of experience in developing and managing stock for rent. Given the strong demand in the private rented sector, this presents a significant opportunity, but one not without its challenges. Developing on the open market means that HAs are more open to the uncertainties of the market.

Land

Financial capacity is just one of the challenges to building new homes. Finding land, obtaining planning permission, construction, sales and management are others.

Buying the right land at the right price becomes increasingly important, as does securing a good pipeline of deliverable sites.

Last year saw increasing activity by HAs in the land market. HAs purchased four times more land during 2016 than they did over the course of 2015.

Earlier this year, London & Quadrant finalised a deal to buy private land business Gallagher Estates for £505m. Through the deal, L&Q secured land for 42,500 homes, mainly in the south Midlands and the south of England. It will also add the significant skills and expertise of one of the UK’s leading strategic land companies to help L&Q achieve its aim of building 100,000 properties over 10 years.

Other HAs would like to see a role for government in addressing the issue of land, for example by providing preferential access to public land as a means of unlocking delivery.

Efficiency

Last year, two reports - “Housing Association Operational Efficiency” (NHF and Housemark), and “Delivering Better Value for Money Understanding Differences in Unit Costs” (HCA) -highlighted the importance of operational efficiency in HAs.

As a response, the Efficiencies Working Group has developed the Sector Scorecard- a set of 15 indicators developed to benchmark efficiency across the sector. The aim is for these indicators to become the mainstream way by which efficiency and effectiveness are measured.

HAs reinvest any surplus that they generate back into housing and housebuilding. This means that driving efficiency in their operations and delivery is critical - not for shareholder profits, but rather for the delivery of their social mission through increased and ongoing long-term investment in housing.

Mergers

Mergers could give the critical mass needed for a more ambitious programme of HA delivery.

Last year, Affinity Sutton and Circle Housing Group merged to become the largest HA in the UK, and one of the largest housebuilders. L&Q and East Thames also announced the completion of their merger and details of a £2.6bn financing package.

Peabody plans to raise £1bn over the next three years as it increases development following its merger with Family Mosaic.

Product development and diversification:

In the face of fiscal austerity, HAs will increasingly look to develop new products and offerings to different customer groups and through new types of partnerships. For example:

- Liverpool Housing Development Partnership is an agreement between the city’s largest HA – Liverpool Mutual Homes, Liverpool City Council, private developer Redrow Homes and property contractor Wilmott Dixon – and will jointly build 1,500 new homes and bring 100 empty homes back into use.

- Your Housing Group has announced a historic joint venture deal with Welink Group which will see thousands of homes built across the UK through an initial investment – while also accessing China National Building Material Company’s (CNBM) technology, financial support and leverage for additional investment in the UK. As part of the deal, the joint venture will also build up to six factories at strategic locations across the UK which will produce up to 25,000 homes per year, making it the UK’s leading modular housing developer.

- LoCal Homes, the Accord Group’s award winning off-site manufacturing hub, is another example of HAs embracing modern construction methods.

Financial capacity is just one of the challenges to building new homes. Finding land, obtaining planning permission, construction, sales and management are others.

Efficiency

Last year, two reports - “Housing Association Operational Efficiency” (NHF and Housemark), and “Delivering Better Value for Money Understanding Differences in Unit Costs” (HCA) -highlighted the importance of operational efficiency in HAs.

As a response, the Efficiencies Working Group has developed the Sector Scorecard- a set of 15 indicators developed to benchmark efficiency across the sector. The aim is for these indicators to become the mainstream way by which efficiency and effectiveness are measured.

HAs reinvest any surplus that they generate back into housing and housebuilding. This means that driving efficiency in their operations and delivery is critical - not for shareholder profits, but rather for the delivery of their social mission through increased and ongoing long-term investment in housing.

Mergers

Mergers could give the critical mass needed for a more ambitious programme of HA delivery.

Last year, Affinity Sutton and Circle Housing Group merged to become the largest HA in the UK, and one of the largest housebuilders. L&Q and East Thames also announced the completion of their merger and details of a £2.6bn financing package.

Peabody plans to raise £1bn over the next three years as it increases development following its merger with Family Mosaic.

Product development and diversification

In the face of fiscal austerity, HAs will increasingly look to develop new products and offerings to different customer groups and through new types of partnerships. For example:

- Liverpool Housing Development Partnership is an agreement between the city’s largest HA – Liverpool Mutual Homes, Liverpool City Council, private developer Redrow Homes and property contractor Wilmott Dixon – and will jointly build 1,500 new homes and bring 100 empty homes back into use.

- Your Housing Group has announced a historic joint venture deal with Welink Group which will see thousands of homes built across the UK through an initial investment – while also accessing China National Building Material Company’s (CNBM) technology, financial support and leverage for additional investment in the UK. As part of the deal, the joint venture will also build up to six factories at strategic locations across the UK which will produce up to 25,000 homes per year, making it the UK’s leading modular housing developer.

- LoCal Homes, the Accord Group’s award winning off-site manufacturing hub, is another example of HAs embracing modern construction methods.

Drawing on our expertise in the Build-to-Rent and mixed-use sector, Chapman Taylor is investigating new delivery models that can help our HAs exploit this business opportunity.

In summary, the HA sector has adapted well to a period of unprecedented change and fiscal austerity, and is well placed to develop increased levels of affordable housing. Drawing on our expertise in the Build-to-Rent and mixed-use sector, Chapman Taylor is investigating new delivery models that can help our HAs exploit this business opportunity.